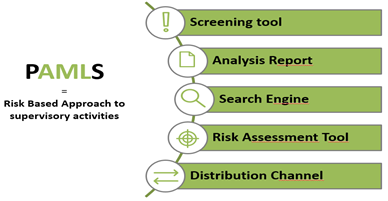

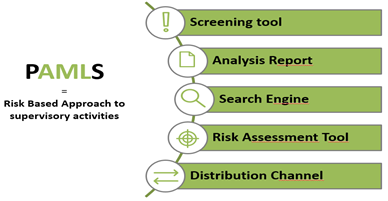

PAMLS to Improve Risk Based Supervision

20th January 2020, Bank of Slovenia, Slovenia : Pilot#8 – Platform for Anti Money Laundering Supervision (PAMLS)

The 4th EU Anti Money Laundering Directive (Directive 2015/849) requires supervisory authorities to consider risks, while carrying out supervisory activities or Risk Based Supervision in short. Risk Based Supervision means that the frequency and intensity of supervisory activities have to be proportionate to the risk of money laundering and terrorist financing to which the supervised financial institution is exposed. In order to define the risk profile of particular financial institution, the supervisory authority need to assess financial institution`s inherent risk, and its control environment to prevent such risks. For determining and evaluating the inherent risk, different data has to be taken into consideration (e.g. the size of the institution, the diversification of the business network, the existence of subsidiaries, the volume of business, the structure of clients, the set of products and services, etc.). As risk based supervision is not a one-off exercise, but an ongoing and cyclical process a wide range of different sources of information need to be combined, used and continually updated.

The pilot will develop a platform (named PAMLS) that will improve the effectiveness of the existing supervisory activities in the area of anti money laundering and combating terrorist financing by processing large quantity of data (Big Data).

PAMLS will provide the following functionalities: (i) Screening tool for screening of payment transactions and detection of potential suspicious transactions; (ii) Analysis reports providing analytical data on financial institution`s (number & volume of transactions, number of alerts generated with screening tool); (iii) Search engine allowing supervisor to look for a specific transaction or a sample of transactions; (iv) Risk assessment tool to assess the risk of the financial institution`s (its inherent risks and control environment) on a risk based approach; (v) Distribution channel for gathering data from other departments within Bank of Slovenia, other supervisory authorities (domestic and foreign) and the financial institutions.